However, the extension doesn't apply to a spouse for any tax year beginning more than two years after the area in question ceases to be a combat zone or an operation ceases to be a contingency operation. Spouses of military personnel who served in a combat zone or contingency operation are generally entitled to this extension, too. Use whichever of these two dates is the latest. First, your deadline is extended for 180 days after (1) the last day you're in a combat zone, have qualifying service outside of the combat zone, or serve in a contingency operation or (2) the last day of any continuous hospitalization for an injury from service in the combat zone or contingency operation, or while performing qualifying service outside of the combat zone. There's a two-step process for figuring the length of this type of tax extension. The deadline for filing your tax return and paying your tax is automatically extended if you serve in a combat zone or contingency operation.

Tax Extensions for People Serving in a Combat Zone If you're granted this tax filing extension, you can't also get the discretionary two-month additional extension mentioned above.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/mature-adult-man-working-in-the-office-525983250-5a907b9ceb97de00371176ca.jpg)

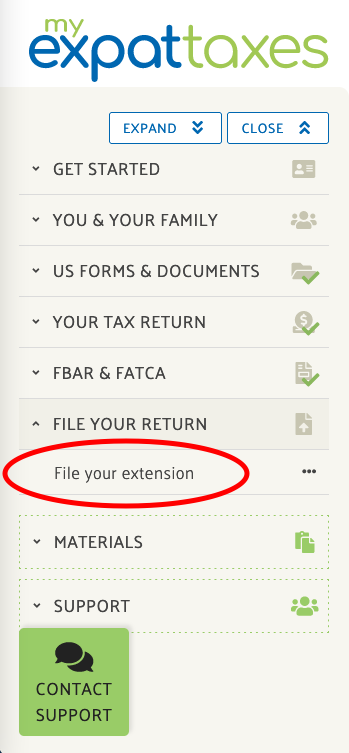

and Puerto Rico on the regular due date of your return, the due date for filing your return for purposes of this extension is June 15 (or the next business day if June 15 falls on a holiday or weekend). Generally, if both your tax home and your abode are outside the U.S. To request this tax extension, file Form 2350 with the IRS by the due date for filing your return. This extension will generally be for 30 days beyond the date that you reasonably expect to qualify for the exclusion or deduction. If you don't hear back from them, you're good to go.Īnd there's more! If you're outside the U.S., you can also request a tax filing extension beyond October 15 if you need time to meet certain tests to qualify for an exclusion or deduction for foreign earned income or housing. The IRS will let you know if the request is denied. To get this extra tax extension, you must send the IRS a letter by the October 15 deadline explaining the reasons why you need the additional two months. This will push the filing deadline to December 15 (or the next business day if December 15 falls on a weekend or holiday). Taxpayers who are out of the country can also request an additional, discretionary two-month filing extension. ( Caution: Even though taxpayers living abroad can get an extra two months to pay any tax due without incurring a penalty, interest still applies to payments received after your regular filing due date.) However, if you and your spouse file separate returns, this extension only applies only to the spouse who qualifies for it. If you're married and filing a joint return, either you or your spouse can qualify for this extension.

(That typically pushes the deadline to June 15, or the next business day if June 15 falls on a Saturday, Sunday or holiday.) Filing Form 4868 isn't required to get this tax extension, but you need to attach a statement explaining which of the two situations described above applies when you eventually file your return. and Puerto Rico, or (2) serving in the military on duty outside the U.S. citizen or resident alien and, on the regular due date of your return, you're (1) living out of the country and your main place of business or duty post is also outside the U.S. First, you're allowed an automatic two-month extension to file your return and pay your taxes if you're a U.S. citizens living outside the country more time to file their federal income tax return. There are also several special rules that provide U.S. Taxpayers Living Abroad Have More Tax Extension Options When you eventually file your tax return (i.e., before the extended due date), you can subtract the extension payment from the tax due as shown on the return.

#FILE EXTENSION TAXES FREE#

If you're filing the form yourself, consider using the IRS Free File or Free File Fillable Forms to prepare and e-file your tax return for free.

#FILE EXTENSION TAXES PROFESSIONAL#

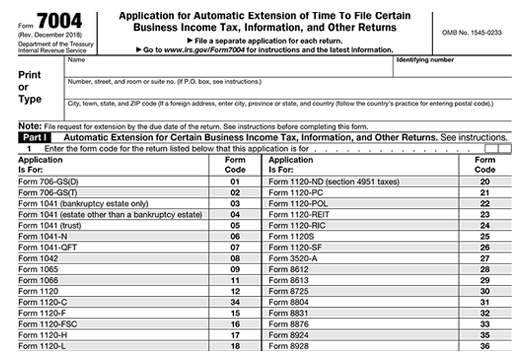

If you submit the form electronically, have a copy of your tax return for the previous year handy, because you'll be asked to provide information from that return to verify your identity (you can e-file the form on your own computer or have a tax professional do it for you). If you're not making a payment, you can use certain private delivery services. box (private delivery services can't deliver items to an IRS P.O. Postal Service to mail the form if you're including a payment, since it must be delivered to a P.O. If you mail a paper version of the form, it must be postmarked by the regular due date of your return. You can send the form to the IRS by mail or electronically. The most common way to get an extension is to file Form 4868.

0 kommentar(er)

0 kommentar(er)